Middle Class Tax Cuts Act

Jul. 25, 2012 | S. 3412

This Democratic legislation would extend tax cuts on income under $250,000 for joint filers ($200,000 for individuals) or about 98% of taxpayers as well as 97% of small business owners. It would end the Bush tax breaks for the richest 2 percent and save the federal government nearly $1 trillion over the next 10 years; revenue that could be invested in jobs, infrastructure improvements, education, and protecting programs like Medicare and Medicaid, as well as reducing the deficit. The middle class tax cut was passed.

This is Good for working people.

Vote result: Passed

YEAs: 51

NAYs: 48

| Legislator Sort descending | State | Party | Vote | |

|---|---|---|---|---|

|

Sen. Daniel Coats |  Republican

Republican

|

No | |

|

Sen. Tom Coburn |  Republican

Republican

|

No | |

|

Sen. Thad Cochran |  Republican

Republican

|

No | |

|

Sen. Susan Collins |  Republican

Republican

|

No | |

|

Sen. Kent Conrad |  Democrat

Democrat

|

Yes | |

|

Sen. Christopher A. Coons |  Democrat

Democrat

|

Yes | |

|

Sen. Bob Corker |  Republican

Republican

|

No | |

|

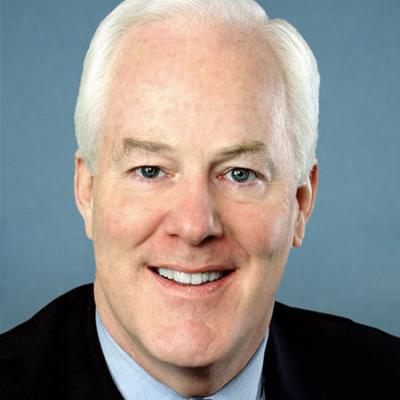

Sen. John Cornyn |  Republican

Republican

|

No | |

|

Sen. Michael D. Crapo |  Republican

Republican

|

No | |

|

Sen. Jim DeMint |  Republican

Republican

|

No | |

|

Sen. Richard J. Durbin |  Democrat

Democrat

|

Yes | |

|

Sen. Michael B. Enzi |  Republican

Republican

|

No | |

|

Sen. Dianne Feinstein |  Democrat

Democrat

|

Yes | |

|

Sen. Al Franken |  Democrat

Democrat

|

Yes | |

|

Sen. Kirsten E. Gillibrand |  Democrat

Democrat

|

Yes | |

|

Sen. Lindsey Graham |  Republican

Republican

|

No | |

|

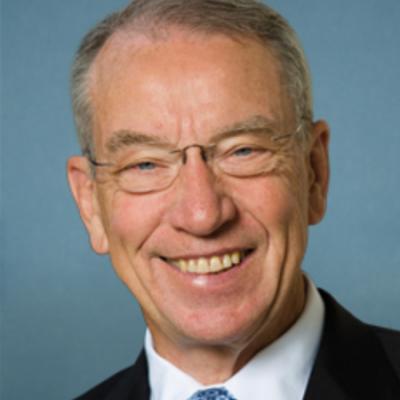

Sen. Charles E. Grassley |  Republican

Republican

|

No | |

|

Sen. Kay Hagan |  Democrat

Democrat

|

Yes | |

|

Sen. Tom Harkin |  Democrat

Democrat

|

Yes | |

|

Sen. Orrin G. Hatch |  Republican

Republican

|

No |

Pagination

2012 Senate Key Votes

- Moving Ahead for Progress in the 21st Century Act

- Jumpstart Our Business Startups

- Paying a Fair Share Act of 2012

- Repeal of NLRB's Fair Election Rules

- Amendment to Limit Union Representation Rights in the Workplace

- Amendment to Circumvent Collective Bargaining Agreements

- Bring Jobs Home Act

- Amendment to Extend the Bush Tax Cuts for the Wealthy

- Middle Class Tax Cuts Act

- Amendment to Repeal Prevailing Wage Laws

- Disaster Relief Appropriations Act, 2013