FY2018 Budget Act Amending the Tax Code to Reduce Tax Rates

Dec. 20, 2017 | H.R. 1

This bill amends the Internal Revenue Code in a way that makes working people pay the price for massive tax giveaways to millionaires and wealthy corporations. In addition to lowering the top tax rate for wealthy individuals and reducing the corporate rate by nearly 40%, the bill lowers the tax rate on offshore profits to zero, which gives corporations a giant incentive to move American jobs offshore. The bill also eliminates the Affordable Care Act's individual mandate, which will mean the loss of health care for 13 million Americans and a 10% premium increase, on average. The bill passed the House and Senate, was signed by President Trump and became law on December 22, 2017.Legislative Alert

This is Bad for working people.

Vote result: Passed

YEAs: 224

NAYs: 201

| Legislator | State | District Sort descending | Party | Vote | |

|---|---|---|---|---|---|

|

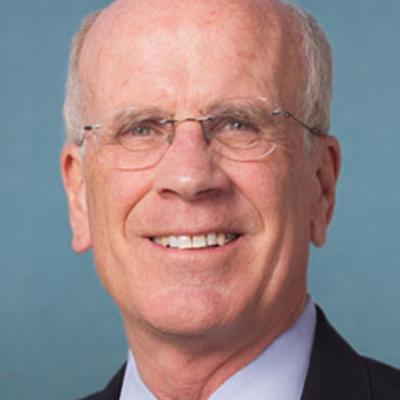

Sen. Peter Welch |  Democrat

Democrat

|

No | ||

|

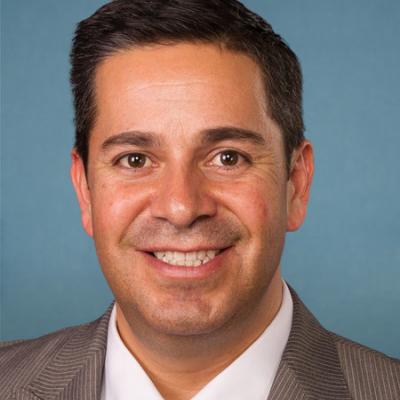

Sen. Ben Ray Luján |  Democrat

Democrat

|

No | ||

|

Sen. Roger Marshall |  Republican

Republican

|

Yes | ||

|

Sen. Martha McSally |  Republican

Republican

|

Yes | ||

|

Sen. Markwayne Mullin |  Republican

Republican

|

Yes | ||

|

Sen. Marsha Blackburn |  Republican

Republican

|

Yes | ||

|

Sen. Ted Budd |  Republican

Republican

|

Yes | ||

|

Sen. Jacky Rosen |  Democrat

Democrat

|

No | ||

|

Sen. Kevin Cramer |  Republican

Republican

|

Yes | ||

|

Sen. Kyrsten Sinema | ID ID | No | ||

|

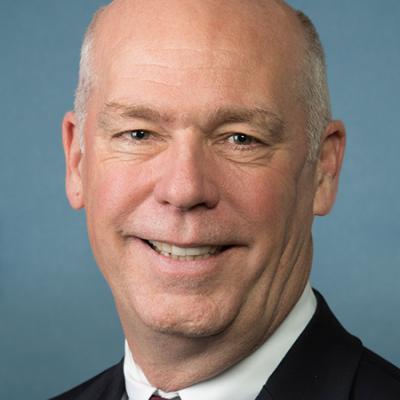

Rep. Greg Gianforte | At Large |  Republican

Republican

|

Yes | |

|

Rep. Don Young | At Large |  Republican

Republican

|

Yes | |

|

Rep. Lisa Blunt Rochester | At Large |  Democrat

Democrat

|

No | |

|

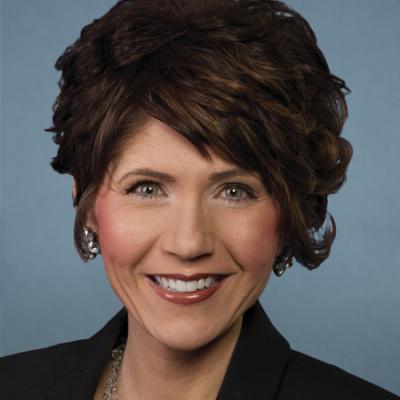

Rep. Kristi Noem | At Large |  Republican

Republican

|

Yes | |

|

Rep. Liz Cheney | At Large |  Republican

Republican

|

Yes | |

|

Rep. Louie Gohmert | 1 |  Republican

Republican

|

Yes | |

|

Rep. Peter J. Visclosky | 1 |  Democrat

Democrat

|

No | |

|

Rep. Tim Walz | 1 |  Democrat

Democrat

|

No | |

|

Rep. Colleen Hanabusa | 1 |  Democrat

Democrat

|

No | |

|

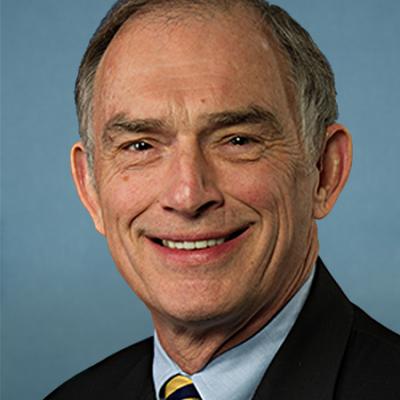

Rep. Andy Harris | 1 |  Republican

Republican

|

Yes |

Pagination

2017 House Key Votes

- Midnight Rules Relief Act

- Regulations from the Executive in Need of Scrutiny (REINS) Act

- Regulatory Accountability Act

- FY2017 Budget Resolution

- Resolution Overturning the Fair Pay and Safe Workplace Rule

- Resolution Overturning the Retirement Plan Safe Harbor Rule

- SCRUB Act of 2017

- Resolution Overturning the OSHA Injury and Illness Reporting Rule

- Regulatory Integrity Act of 2017

- Fairness in Class Action Litigation and Furthering Asbestos Claim Transparency Act

- VA Accountability First Act

- Small Business Health Fairness Act

- Register of Copyrights Selection and Accountability Act

- Working Families Flexibility Act

- American Health Care Act

- Department of Veterans Affairs Accountability and Whistleblower Protection Act

- No Sanctuary for Criminals Act

- Kate's Law

- Amendment to Expedite Military Base Realignments and Closures

- Amendment to Repeal Prevailing Wage Laws

- Resolution Overturning Forced Arbitration Ban

- Amendment to Repeal Prevailing Wage Laws

- Amendment Prohibiting the Outsourcing of Federal Civilian Jobs

- Amendment to Repeal Prevailing Wage Laws

- Amendment to Cut Funds for the Essential Air Service Program

- Amendment to Eliminate Funds for the Gateway Rail Project

- Amendment to Defund Amtrak

- Amendment to Repeal Prevailing Wage Laws

- Amendment to Repeal Prevailing Wage Laws

- Amendment to Cut the National Labor Relations Board Budget

- Amendment to Cut Funding at the Mine Safety and Health Administration

- Amendment to Repeal the NLRB Election Modernization Rule

- Amendment to Repeal OSHA's Improved Injury Reporting Rules

- FY2018 Budget Resolution

- CHAMPIONING HEALTHY KIDS Act

- Save Local Business Act

- FY2018 Budget Act Amending the Tax Code to Reduce Tax Rates

- Corporate Governance Reform and Transparency Act