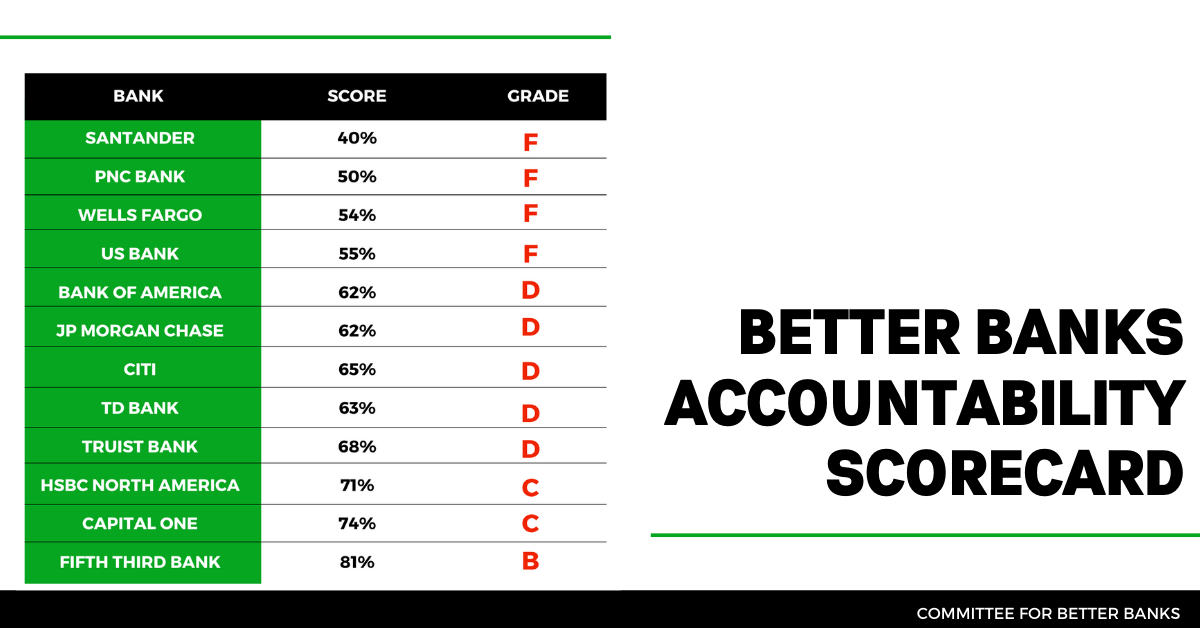

A new report released by the Committee for Better Banks (CBB) shows the urgent need for major financial institutions to protect the physical health of employees and customers and to protect customers' economic assets. CBB analyzed 12 of the nation's top banks, with combined total assets of $8.5 trillion and $155 billion in profits last year. The report ranked banks according to worker protections, lending policies, consumer protections and charitable contributions in response to the COVID-19 pandemic.

Nick Weiner, lead organizer for CBB, said:

Throughout the pandemic, CBB has heard from bank workers across the country about the lack of safety measures and financial protections both for employees and their customers. This led us to do a deep, comprehensive review of how U.S. banks have responded to COVID-19 and ensure that, as new cases are skyrocketing, bank executives know what they must improve. While banks’ poor grades did not surprise us, the inconsistencies across the banking industry around worker and customer protections is truly alarming and speaks to the urgent need to secure a place at the table for front-line workers. In 2008, taxpayers ended up footing the bill for bailing out Wall Street and big banks for malfeasance perpetrated on millions of homeowners, while working people lost their homes and were left struggling. With 30 percent of Americans missing their housing payments in June and experts warning of a looming housing apocalypse, we cannot afford to make that same mistake again.

Read the full report and sign the petition that calls on the banks to take the following steps:

- Form a committee to develop industrywide policies in support of the health and financial well-being of front-line workers and consumers.

- Provide front-line workers with increased protections, including hazard pay, paid sick leave, adequate personal protective equipment and job security.

- Increase employment levels, improve training and transparency of policies to ensure communities, ensure customers and small businesses receive the real financial support they need, including increased flexibility for customers in need and waiving fees for customers, while maximizing support for small businesses.