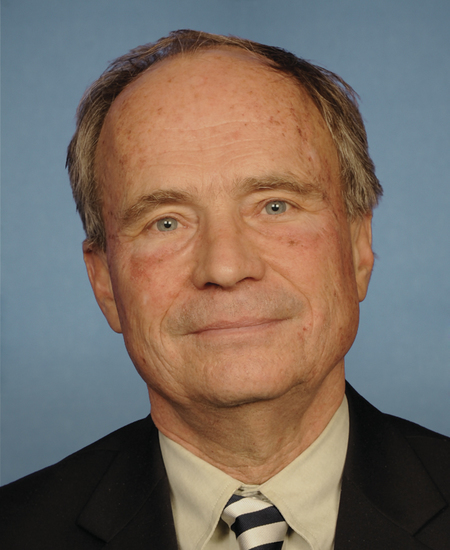

Rep. Charles F. Bass

Rep. Charles F. Bass

New Hampshire

District 2

Republican

35%

2012 Score

19%

Average House Republican

18%

Lifetime Score

| Date | Key Vote | Vote |

|---|---|---|

Aug

02

2012

|

Pathway to Job Creation through a Simpler, Fairer Tax Code Act of 2012 This bill would fast track a Republican plan to overhaul the tax code that would cut taxes for the wealthy and corporations, increase tax incentives for corporations that ship U.S. jobs overseas, raise taxes on the middle class, and increase income inequality and the federal deficit. |

|

Aug

01

2012

|

Amendment to Extend Middle-Class Tax Cuts This amendment would permanently extend tax cuts on income under $250,000 for joint filers ($200,000 for individuals), or about 98 percent of taxpayers and 97 percent of small business owners and would save the federal government nearly $1 trillion over the next 10 years. |

|

Aug

01

2012

|

American Taxpayer Relief Act of 2012 Not only would the Republican bill extend the Bush tax cuts for the wealthiest 2 percent of taxpayers, H.R. 8 would also raise taxes on approximately 25 million middle and low income households by ending important tax credits for parents raising children and paying for college. |

|

Jul

26

2012

|

Red Tape Reduction and Small Business Job Creation Act As part of their so-called "jobs plan," House Republicans offered a bill that would in effect ban any new federal regulations--from job safety to rules for big banks and public health-- until the unemployment rate drops to 6% or less. |

|

Jul

18

2012

|

Amendment to Repeal Prevailing Wage Laws This amendment to the Department of Defense Appropriations Act, 2013 (H.R. 5856) would have repealed Davis-Bacon coverage for projects funded under this bill. |

|

Jul

11

2012

|

Repeal of Obamacare Act Shortly after the U.S. Supreme Court ruled that the Affordable Care Act (ACA) was constitutional, congressional Republicans held their 33rd vote to repeal the health care reform law. |

|

Jun

08

2012

|

Moving Ahead for Progress in the 21st Century Act Rep. Paul Broun (R-Ga.), offered a motion to instruct conferees to drastically cut the funding, especially for mass transit, which would jeopardize hundreds of thousands of jobs. |

|

Jun

06

2012

|

Amendment to Repeal Prevailing Wage Laws This amendment to the TK TK (H.R. 5325) would have repealed Davis-Bacon coverage for projects funded under this bill. |

|

May

31

2012

|

Amendment to Repeal Prevailing Wage Laws This amendment to the Military Construction and Veterans Affairs Appropriations Act, 2013 (H.R. 5854) would have repealed Davis-Bacon coverage for projects funded under this bill. |

|

May

31

2012

|

Amendment to Strike a Project Labor Agreement Prohibition Provition This amendment to the Military Construction and Veterans Affairs and Related Agencies Appropriations Act, 2013 (H.R. 5854) removed a prohibition on using Project Labor Agreements (PLAs) on projects funded through the bill. |

|

May

18

2012

|

Moving Ahead for Progress in the 21st Century Act Rep. Nick Rahall (D-W.Va.) offered a motion to instruct House conferees to agree to a Senate-passed Buy American requirements, which generally mandate that the materials for federally-funded highway, transit and rail projects be produced in the United States. |

|

May

18

2012

|

Amendment to Privatize Department of Defense Jobs Rep. Mike Coffman (R-Colo.) offered an amendment to the Defense Authorization bill that would make it easier to privatize Defense Department work and services now conducted by civilian DOD employees, and make it more difficult to return contracted work and services to the DOD civilian workforce. |

|

May

17

2012

|

Amendment to Prohibit Project Labor Agreements This amendment to the National Defense Authorization Act for Fiscal Year 2013 (H.R. 4310) prohibited the use of Project Labor Agreements (PLAs) on federal defense construction projects. |

|

May

16

2012

|

Violence Against Women Reauthorization Act of 2012 The Republican bill to reauthorize the 1994 Violence Against Women Act weakens many current protections in the law. It excludes lesbian, gay, bisexual and transgender (LGBT) victims, erodes important provisions for immigrant victims' safety and gives abusers additional tools with which to harm victims. |

|

May

10

2012

|

Sequester Replacement Reconciliation Act of 2012 H.R. 5652 sponsored by Rep. Paul Ryan (R-Wisc.) replaces billions in spending cuts outlined in the 2011 legislation with cuts in programs that are helping millions of families survive the worst economic recession since the Great Depression. |

|

Apr

25

2012

|

Small Business Credit Availability Act This bill offered by Rep. Frank Lucas (R-Okla.) would exempt certain financial institutions that are major players in derivatives trading from provisions of the 2010 Wall Street reform law that would classify those institutions as a type of derivatives trader known as swap dealers. |

|

Apr

19

2012

|

Small Business Tax Cut Act Touted as part of the Republicans so-called "jobs" package, the bill doesn't include a single requirement that businesses create jobs or invest within the United States before qualifying for the new tax deductions. |

|

Mar

29

2012

|

FY2013 Budget Resolution This Republican budget resolution, crafted by Rep. Paul Ryan (R-Wisc.), caps spending and makes major cuts in vital working family programs while cutting tax rates for the richest Americans and Wall Street. |

|

Mar

28

2012

|

Amendment to Cut Funding to Social Security, Medicare and Medicaid This substitute to the Republican budget resolution offered by Rep. Jim Cooper (R-Tenn.) and Rep. Steve LaTourette (R-Ohio) would make makes deep cuts in Social Security benefits, cuts to Medicare benefits and Medicaid, offer more tax incentives for U.S. firms to export jobs overseas, tax working Americans' health benefits and lower tax rates for rich people and Wall Street. |

|

Mar

08

2012

|

Jumpstart Our Business Startups The so-called "Jobs Act" would create few jobs and would instead inevitably weaken investor confidence in our capital markets by creating new and expanded loopholes in our securities laws. |

|