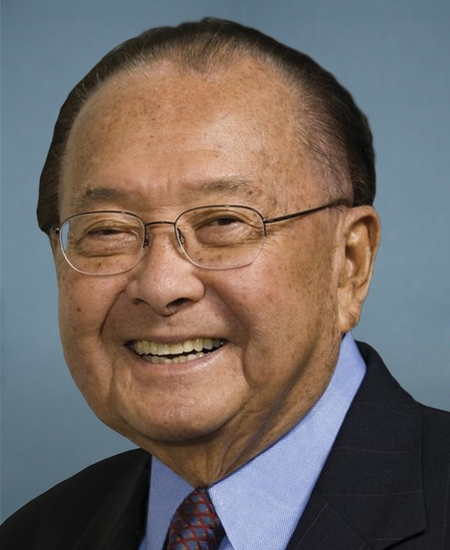

Sen. Daniel K. Inouye

Sen. Daniel K. Inouye

Hawaii

Democrat

89%

2012 Score

95%

Average Senate Democrat

92%

Lifetime Score

| Date | Key Vote | Vote |

|---|---|---|

Jul

25

2012

|

Amendment to Extend the Bush Tax Cuts for the Wealthy Sen. Mitch McConnell (R-Ky.) offered an amendment to the bill that not only would extend the Bush tax cuts for the top 2 percent but also would extend estate tax cuts for estates worth more than $5 million. |

|

Jul

25

2012

|

Middle Class Tax Cuts Act This legislation would extend tax cuts on income under $250,000 for joint filers ($200,000 for individuals) or about 98% of taxpayers as well as 97% of small business owners. It would end the Bush tax breaks for the richest 2 percent and save the federal government nearly $1 trillion over the next 10 years. |

|

Jul

19

2012

|

Bring Jobs Home Act The Bring Jobs Home Act would cut taxes for U.S. companies that move jobs and business operations back to the United States, and end tax loopholes that reward companies that ship jobs overseas. |

|

Jun

21

2012

|

Amendment to Circumvent Collective Bargaining Agreements Under the guise of "strengthening" workers' collective bargaining rights, Sen. Marco Rubio (R-Fla.) offered an amendment to the Farm Bill that would give employers the right to circumvent provisions on wage increases in collective bargaining agreements, supposedly to allow for merit raises. |

|

Apr

25

2012

|

Amendment to Limit Union Representation Rights in the Workplace Sen. Jim DeMint (R-S.C) offered an amendment to the "21st Century Postal Service Act" that would weaken union representation rights in the workplace. |

|

Apr

24

2012

|

Repeal of NLRB's Fair Election Rules Sen. Mike Enzi (R-Wyo.) introduced a resolution to prevent the NLRB from implementing the new, fair union election rules. |

|

Apr

16

2012

|

Paying a Fair Share Act of 2012 The "Paying a Fair Share Act of 2012", sponsored by Sen. Sheldon Whitehouse (D-R.I.), would implement the so-called "Buffett Rule"--a common -sense proposition that the effective federal income tax rate for people who make more than $1 million should be at least 30 percent. |

|

Mar

22

2012

|

Jumpstart Our Business Startups The so-called "Jobs Act" would create few jobs and would instead inevitably weaken investor confidence in our capital markets by creating new and expanded loopholes in our securities laws. |

|

Mar

14

2012

|

Moving Ahead for Progress in the 21st Century Act The bipartisan Moving Ahead for Progress in the 21st Century Act would create millions of transportation infrastructure jobs, boost the economy and fix the nation's crumbling transportation systems. It authorizes $109 billion over two years for highway, highway safety and public transit programs. |

|