Amendment to Extend Middle-Class Tax Cuts

Aug. 1, 2012 | H.Amdt. 1473 to H.R. 8

While House Republicans pushed to extend the Bush tax cuts for the nation's wealthiest 2 percent, Democrats offered an amendment that would permanently extend tax cuts on income under $250,000 for joint filers ($200,000 for individuals), or about 98 percent of taxpayers and 97 percent of small business owners. The Democratic alternative would save the federal government nearly $1 trillion over the next 10 years; revenue that could be invested in jobs, infrastructure improvements, education, and protecting programs like Medicare and Medicaid, as well as reducing the deficit. The middle class tax cut was defeated.

This is Good for working people.

Vote result: Failed

YEAs: 170

NAYs: 257

| Legislator Sort descending | State | District | Party | Vote | |

|---|---|---|---|---|---|

|

Rep. Peter A. DeFazio | 4 |  Democrat

Democrat

|

Yes | |

|

Rep. Diana DeGette | 1 |  Democrat

Democrat

|

Yes | |

|

Rep. Rosa DeLauro | 3 |  Democrat

Democrat

|

Yes | |

|

Rep. Jeffrey Denham | 10 |  Republican

Republican

|

No | |

|

Rep. Charlie Dent | 15 |  Republican

Republican

|

No | |

|

Rep. Scott DesJarlais | 4 |  Republican

Republican

|

No | |

|

Rep. Ted Deutch | 22 |  Democrat

Democrat

|

Yes | |

|

Rep. Mario Diaz-Balart | 26 |  Republican

Republican

|

No | |

|

Rep. Norman D. Dicks | 6 |  Democrat

Democrat

|

Yes | |

|

Rep. John D. Dingell | 12 |  Democrat

Democrat

|

Yes | |

|

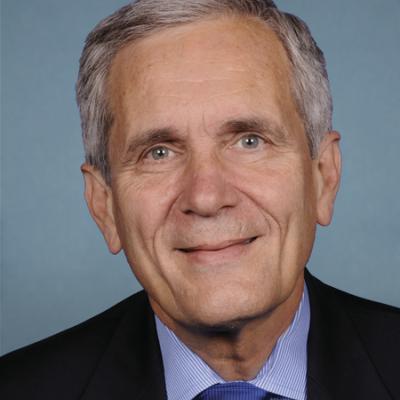

Rep. Lloyd Doggett | 37 |  Democrat

Democrat

|

Yes | |

|

Rep. Robert Dold | 10 |  Republican

Republican

|

No | |

|

Sen. Joe Donnelly |  Democrat

Democrat

|

No | ||

|

Rep. Mike Doyle | 18 |  Democrat

Democrat

|

Yes | |

|

Rep. David Dreier | 26 |  Republican

Republican

|

No | |

|

Rep. Sean Duffy | 7 |  Republican

Republican

|

No | |

|

Rep. John J. Duncan Jr. | 2 |  Republican

Republican

|

No | |

|

Rep. Jeffrey Duncan | 3 |  Republican

Republican

|

No | |

|

Rep. Donna Edwards | 4 |  Democrat

Democrat

|

Yes | |

|

Rep. Keith Ellison | 5 |  Democrat

Democrat

|

Yes |

Pagination

2012 House Key Votes

- Countervailing Duty Provisions to Non-market Economy Countries

- Jumpstart Our Business Startups

- Amendment to Cut Funding to Social Security, Medicare and Medicaid

- FY2013 Budget Resolution

- Small Business Tax Cut Act

- Small Business Credit Availability Act

- Sequester Replacement Reconciliation Act of 2012

- Violence Against Women Reauthorization Act of 2012

- Amendment to Prohibit Project Labor Agreements

- Amendment to Privatize Department of Defense Jobs

- Moving Ahead for Progress in the 21st Century Act

- Amendment to Strike a Project Labor Agreement Prohibition Provition

- Amendment to Repeal Prevailing Wage Laws

- Amendment to Repeal Prevailing Wage Laws

- Moving Ahead for Progress in the 21st Century Act

- Repeal of Obamacare Act

- Amendment to Repeal Prevailing Wage Laws

- Red Tape Reduction and Small Business Job Creation Act

- Amendment to Extend Middle-Class Tax Cuts

- American Taxpayer Relief Act of 2012

- Pathway to Job Creation through a Simpler, Fairer Tax Code Act of 2012