American Taxpayer Relief Act of 2012

Aug. 1, 2012 | H.R. 8

Not only would the Republican bill extend the Bush tax cuts for the wealthiest 2 percent of taxpayers, H.R. 8 would also raise taxes on approximately 25 million middle and low income households by ending important tax credits for parents raising children and paying for college. Under this plan, the top 2 percent would get an average tax cut of $150,000 per year. The Republican proposal would eliminate programs for low income families, including the refundable tax credit for college tuition, and both the 2009 expansion of the Child Tax Credit and the Earned Income Tax Credit. The tax cut for the rich passed.

This is Bad for working people.

Vote result: Passed

YEAs: 256

NAYs: 171

| Legislator Sort descending | State | District | Party | Vote | |

|---|---|---|---|---|---|

|

Rep. Peter A. DeFazio | 4 |  Democrat

Democrat

|

No | |

|

Rep. Diana DeGette | 1 |  Democrat

Democrat

|

No | |

|

Rep. Rosa DeLauro | 3 |  Democrat

Democrat

|

No | |

|

Rep. Jeffrey Denham | 10 |  Republican

Republican

|

Yes | |

|

Rep. Charlie Dent | 15 |  Republican

Republican

|

Yes | |

|

Rep. Scott DesJarlais | 4 |  Republican

Republican

|

Yes | |

|

Rep. Ted Deutch | 22 |  Democrat

Democrat

|

No | |

|

Rep. Mario Diaz-Balart | 26 |  Republican

Republican

|

Yes | |

|

Rep. Norman D. Dicks | 6 |  Democrat

Democrat

|

No | |

|

Rep. John D. Dingell | 12 |  Democrat

Democrat

|

No | |

|

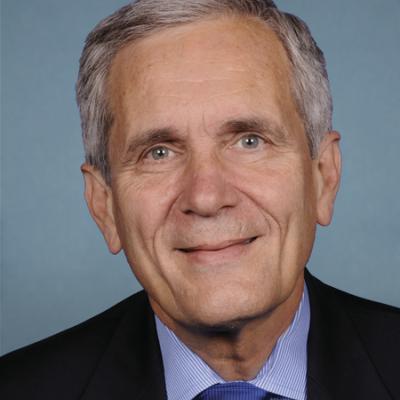

Rep. Lloyd Doggett | 37 |  Democrat

Democrat

|

No | |

|

Rep. Robert Dold | 10 |  Republican

Republican

|

Yes | |

|

Sen. Joe Donnelly |  Democrat

Democrat

|

Yes | ||

|

Rep. Mike Doyle | 18 |  Democrat

Democrat

|

No | |

|

Rep. David Dreier | 26 |  Republican

Republican

|

Yes | |

|

Rep. Sean Duffy | 7 |  Republican

Republican

|

Yes | |

|

Rep. John J. Duncan Jr. | 2 |  Republican

Republican

|

Yes | |

|

Rep. Jeffrey Duncan | 3 |  Republican

Republican

|

Yes | |

|

Rep. Donna Edwards | 4 |  Democrat

Democrat

|

No | |

|

Rep. Keith Ellison | 5 |  Democrat

Democrat

|

No |

Pagination

2012 House Key Votes

- Countervailing Duty Provisions to Non-market Economy Countries

- Jumpstart Our Business Startups

- Amendment to Cut Funding to Social Security, Medicare and Medicaid

- FY2013 Budget Resolution

- Small Business Tax Cut Act

- Small Business Credit Availability Act

- Sequester Replacement Reconciliation Act of 2012

- Violence Against Women Reauthorization Act of 2012

- Amendment to Prohibit Project Labor Agreements

- Amendment to Privatize Department of Defense Jobs

- Moving Ahead for Progress in the 21st Century Act

- Amendment to Strike a Project Labor Agreement Prohibition Provition

- Amendment to Repeal Prevailing Wage Laws

- Amendment to Repeal Prevailing Wage Laws

- Moving Ahead for Progress in the 21st Century Act

- Repeal of Obamacare Act

- Amendment to Repeal Prevailing Wage Laws

- Red Tape Reduction and Small Business Job Creation Act

- Amendment to Extend Middle-Class Tax Cuts

- American Taxpayer Relief Act of 2012

- Pathway to Job Creation through a Simpler, Fairer Tax Code Act of 2012