Small Business Tax Cut Act

Apr. 19, 2012 | H.R. 9

Touted as part of the Republicans so-called "jobs" package, the bill doesn't include a single requirement that businesses create jobs or invest within the United States before qualifying for the new tax deductions. It simply adds even more tax loop holes for businesses to take advantage of. It allows businesses with fewer less than 500 employees to deduct 20% of their domestic business income. The Joint Committee on Taxation found that H.R. 9's impact on economic growth and jobs is "so small as to be incalculable." The Urban-Brookings Tax Policy Center estimates that nearly half of the $46 billion tax cut would go to people with incomes more than $1 million a year. The bill passed.

This is Bad for working people.

Vote result: Passed

YEAs: 235

NAYs: 173

| Legislator Sort descending | State | District | Party | Vote | |

|---|---|---|---|---|---|

|

Rep. Kurt Schrader | 5 |  Democrat

Democrat

|

No | |

|

Rep. Allyson Y. Schwartz | 13 |  Democrat

Democrat

|

No | |

|

Rep. David Schweikert | 1 |  Republican

Republican

|

Yes | |

|

Rep. David Scott | 13 |  Democrat

Democrat

|

No | |

|

Rep. Austin Scott | 8 |  Republican

Republican

|

Yes | |

|

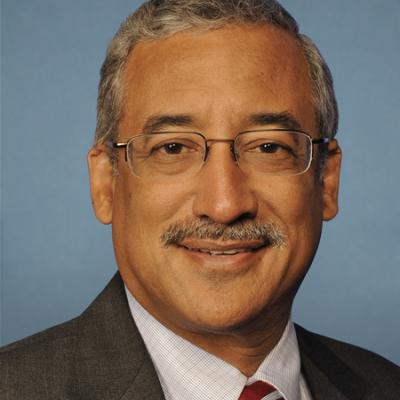

Rep. Robert C. Scott | 3 |  Democrat

Democrat

|

No | |

|

Sen. Tim Scott |  Republican

Republican

|

Yes | ||

|

Rep. F. James Sensenbrenner | 5 |  Republican

Republican

|

Yes | |

|

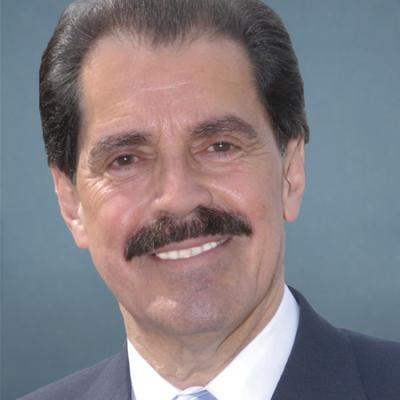

Rep. José E. Serrano | 15 |  Democrat

Democrat

|

No | |

|

Rep. Pete Sessions | 17 |  Republican

Republican

|

Yes | |

|

Rep. Terri Sewell | 7 |  Democrat

Democrat

|

No | |

|

Rep. Brad Sherman | 32 |  Democrat

Democrat

|

No | |

|

Rep. John Shimkus | 15 |  Republican

Republican

|

Yes | |

|

Rep. Heath Shuler | 11 |  Democrat

Democrat

|

No | |

|

Rep. Bill Shuster | 9 |  Republican

Republican

|

Yes | |

|

Rep. Mike Simpson | 2 |  Republican

Republican

|

Yes | |

|

Rep. Albio Sires | 8 |  Democrat

Democrat

|

No | |

|

Rep. Louise M. Slaughter | 25 |  Democrat

Democrat

|

Not Voting | |

|

Rep. Adam Smith | 9 |  Democrat

Democrat

|

No | |

|

Rep. Lamar Smith | 21 |  Republican

Republican

|

Yes |

Pagination

2012 House Key Votes

- Countervailing Duty Provisions to Non-market Economy Countries

- Jumpstart Our Business Startups

- Amendment to Cut Funding to Social Security, Medicare and Medicaid

- FY2013 Budget Resolution

- Small Business Tax Cut Act

- Small Business Credit Availability Act

- Sequester Replacement Reconciliation Act of 2012

- Violence Against Women Reauthorization Act of 2012

- Amendment to Prohibit Project Labor Agreements

- Amendment to Privatize Department of Defense Jobs

- Moving Ahead for Progress in the 21st Century Act

- Amendment to Strike a Project Labor Agreement Prohibition Provition

- Amendment to Repeal Prevailing Wage Laws

- Amendment to Repeal Prevailing Wage Laws

- Moving Ahead for Progress in the 21st Century Act

- Repeal of Obamacare Act

- Amendment to Repeal Prevailing Wage Laws

- Red Tape Reduction and Small Business Job Creation Act

- Amendment to Extend Middle-Class Tax Cuts

- American Taxpayer Relief Act of 2012

- Pathway to Job Creation through a Simpler, Fairer Tax Code Act of 2012