Financial Stability Oversight Council Improvement Act

Apr. 11, 2018 | H.R. 4061

This misnamed bill adds a number of unnecessary procedural obstacles to the already cumbersome and time-consuming process the Financial Stability Oversight Council (FSOC) uses to designate large, non-bank financial entities for increased oversight. The 2008 financial crisis made it obvious that proper consolidated oversight of large non-banks is critical to financial stability. Non-bank financial institutions such as AIG were central contributors to the 2008 crisis and the ensuing economic collapse. The FSOC’s ability to designate non-bank financial companies for enhanced prudential supervision is a crucial line of defense against future systemic risks from non-banks. If enacted this bill has the potential to unravel the regulatory system aimed at preventing the need for future bailouts of “too-big-to-fail” financial institutions. The bill passed on April 11, 2018, and referred to the Senate Banking Committee.

This is Bad for working people.

Vote result: Passed

YEAs: 297

NAYs: 121

| Legislator Sort descending | State | District | Party | Vote | |

|---|---|---|---|---|---|

|

Rep. Terri Sewell | 7 |  Democrat

Democrat

|

Yes | |

|

Rep. Carol Shea-Porter | 1 |  Democrat

Democrat

|

Not Voting | |

|

Rep. Brad Sherman | 32 |  Democrat

Democrat

|

Yes | |

|

Rep. John Shimkus | 15 |  Republican

Republican

|

Yes | |

|

Rep. Bill Shuster | 9 |  Republican

Republican

|

Yes | |

|

Rep. Mike Simpson | 2 |  Republican

Republican

|

Not Voting | |

|

Sen. Kyrsten Sinema | ID ID | Yes | ||

|

Rep. Albio Sires | 8 |  Democrat

Democrat

|

No | |

|

Rep. Adam Smith | 9 |  Democrat

Democrat

|

No | |

|

Rep. Lamar Smith | 21 |  Republican

Republican

|

Yes | |

|

Rep. Christopher H. Smith | 4 |  Republican

Republican

|

Yes | |

|

Rep. Adrian Smith | 3 |  Republican

Republican

|

Yes | |

|

Rep. Jason Smith | 8 |  Republican

Republican

|

Yes | |

|

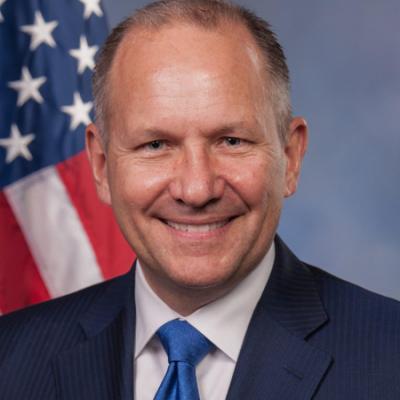

Rep. Lloyd Smucker | 11 |  Republican

Republican

|

Yes | |

|

Rep. Darren Soto | 9 |  Democrat

Democrat

|

No | |

|

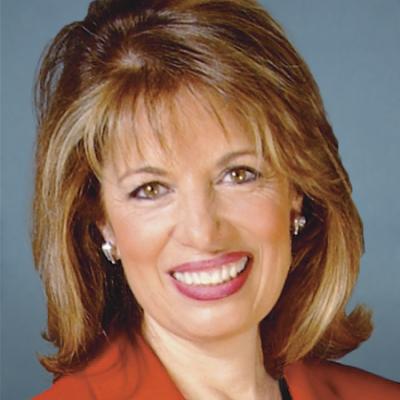

Rep. Jackie Speier | 14 |  Democrat

Democrat

|

No | |

|

Rep. Elise Stefanik | 21 |  Republican

Republican

|

Yes | |

|

Rep. Chris Stewart | 2 |  Republican

Republican

|

Yes | |

|

Rep. Steve Stivers | 15 |  Republican

Republican

|

Yes | |

|

Rep. Thomas Suozzi | 3 |  Democrat

Democrat

|

Yes |

Pagination

- Tribal Labor Sovereignty Act

- Financial Stability Oversight Council Improvement Act

- Stress Test Improvement Act

- Proposing a Balanced Budget Amendment to the U.S. Constitution

- Volcker Rule Regulatory Harmonization Act

- Amendment to the FAA Reauthorization Act of 2018 Striking Prevailing Wage Requirements

- FAA Reauthorization Act of 2018

- Water Resources Development Act of 2018

- Securing America's Future Act of 2018

- Agriculture and Nutrition Act of 2018

- Financial Services and General Government Appropriations, 2019

- Increasing Access to Lower Premium Plans and Expanding Health Savings Accounts Act of 2018

- Restoring Access to Medication and Modernizing Health Savings Accounts Act of 2018

- Protecting Family and Small Business Tax Cuts Act of 2018

- Motion to Concur on a Bill That Gives More Tax Cuts for the Wealthy and Corporations