Financial Stability Oversight Council Improvement Act

Apr. 11, 2018 | H.R. 4061

This misnamed bill adds a number of unnecessary procedural obstacles to the already cumbersome and time-consuming process the Financial Stability Oversight Council (FSOC) uses to designate large, non-bank financial entities for increased oversight. The 2008 financial crisis made it obvious that proper consolidated oversight of large non-banks is critical to financial stability. Non-bank financial institutions such as AIG were central contributors to the 2008 crisis and the ensuing economic collapse. The FSOC’s ability to designate non-bank financial companies for enhanced prudential supervision is a crucial line of defense against future systemic risks from non-banks. If enacted this bill has the potential to unravel the regulatory system aimed at preventing the need for future bailouts of “too-big-to-fail” financial institutions. The bill passed on April 11, 2018, and referred to the Senate Banking Committee.

This is Bad for working people.

Vote result: Passed

YEAs: 297

NAYs: 121

| Legislator Sort descending | State | District | Party | Vote | |

|---|---|---|---|---|---|

|

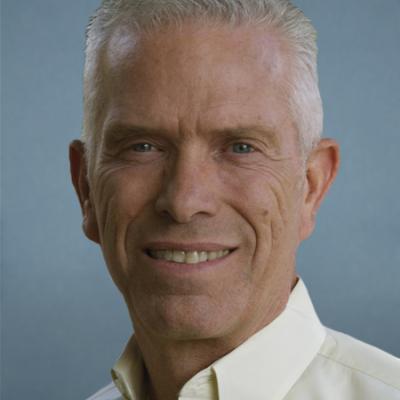

Rep. Jared Huffman | 2 |  Democrat

Democrat

|

No | |

|

Rep. Bill Huizenga | 4 |  Republican

Republican

|

Yes | |

|

Rep. Randy Hultgren | 14 |  Republican

Republican

|

Yes | |

|

Rep. Duncan D. Hunter | 50 |  Republican

Republican

|

Yes | |

|

Rep. Will Hurd | 23 |  Republican

Republican

|

Yes | |

|

Rep. Darrell Issa | 48 |  Republican

Republican

|

Yes | |

|

Rep. Sheila Jackson Lee | 18 |  Democrat

Democrat

|

No | |

|

Rep. Pramila Jayapal | 7 |  Democrat

Democrat

|

No | |

|

Rep. Hakeem Jeffries | 8 |  Democrat

Democrat

|

No | |

|

Rep. Evan Jenkins | 3 |  Republican

Republican

|

Yes | |

|

Rep. Lynn Jenkins | 2 |  Republican

Republican

|

Yes | |

|

Rep. Sam Johnson | 3 |  Republican

Republican

|

Yes | |

|

Rep. Eddie Bernice Johnson | 30 |  Democrat

Democrat

|

No | |

|

Rep. Bill Johnson | 6 |  Republican

Republican

|

Yes | |

|

Rep. Mike Johnson | 4 |  Republican

Republican

|

Yes | |

|

Rep. Hank Johnson | 4 |  Democrat

Democrat

|

No | |

|

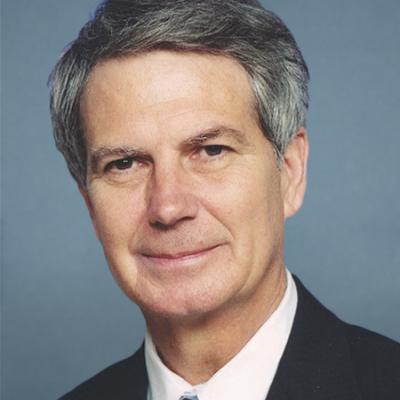

Rep. Walter B. Jones | 3 |  Republican

Republican

|

No | |

|

Rep. Jim Jordan | 4 |  Republican

Republican

|

Yes | |

|

Rep. Dave Joyce | 14 |  Republican

Republican

|

Yes | |

|

Rep. Marcy Kaptur | 9 |  Democrat

Democrat

|

No |

Pagination

- Tribal Labor Sovereignty Act

- Financial Stability Oversight Council Improvement Act

- Stress Test Improvement Act

- Proposing a Balanced Budget Amendment to the U.S. Constitution

- Volcker Rule Regulatory Harmonization Act

- Amendment to the FAA Reauthorization Act of 2018 Striking Prevailing Wage Requirements

- FAA Reauthorization Act of 2018

- Water Resources Development Act of 2018

- Securing America's Future Act of 2018

- Agriculture and Nutrition Act of 2018

- Financial Services and General Government Appropriations, 2019

- Increasing Access to Lower Premium Plans and Expanding Health Savings Accounts Act of 2018

- Restoring Access to Medication and Modernizing Health Savings Accounts Act of 2018

- Protecting Family and Small Business Tax Cuts Act of 2018

- Motion to Concur on a Bill That Gives More Tax Cuts for the Wealthy and Corporations