Motion to Concur on a Bill That Gives More Tax Cuts for the Wealthy and Corporations

Dec. 20, 2018 | H.R. 88

This motion to concur on a bill that gives more tax cuts for the wealthy and corporations—The Retirement, Savings and Other Tax Relief Act (H.R. 88)—is an excuse to cut critical priorities for working people such as Social Security, Medicare, Medicaid, infrastructure, and education in the future. The Congressional Budget Office and the Joint Committee on Taxation estimate that H.R. 88 would cost $54.7 billion over 10 years. In addition, H.R. 88 includes handouts and favors to narrowly tailored and wealthy special interests. The motion to concur passed the House on Dec. 20, 2018.

This is Bad for working people.

Vote result: Passed

YEAs: 220

NAYs: 183

| Legislator Sort descending | State | District | Party | Vote | |

|---|---|---|---|---|---|

|

Rep. Billy Long | 7 |  Republican

Republican

|

Yes | |

|

Rep. Barry Loudermilk | 11 |  Republican

Republican

|

Yes | |

|

Rep. Mia Love | 4 |  Republican

Republican

|

Not Voting | |

|

Rep. Alan Lowenthal | 47 |  Democrat

Democrat

|

Not Voting | |

|

Rep. Nita M. Lowey | 17 |  Democrat

Democrat

|

No | |

|

Rep. Frank D. Lucas | 3 |  Republican

Republican

|

Yes | |

|

Rep. Blaine Luetkemeyer | 3 |  Republican

Republican

|

Yes | |

|

Sen. Ben Ray Luján |  Democrat

Democrat

|

No | ||

|

Rep. Michelle Lujan Grisham | 1 |  Democrat

Democrat

|

Not Voting | |

|

Rep. Stephen F. Lynch | 8 |  Democrat

Democrat

|

No | |

|

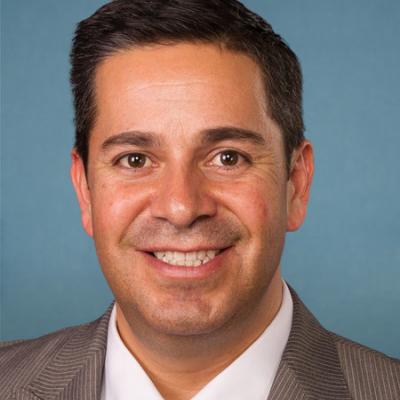

Rep. Tom MacArthur | 3 |  Republican

Republican

|

Yes | |

|

Rep. Carolyn B. Maloney | 12 |  Democrat

Democrat

|

No | |

|

Rep. Sean Patrick Maloney | 18 |  Democrat

Democrat

|

No | |

|

Rep. Kenny Marchant | 24 |  Republican

Republican

|

Yes | |

|

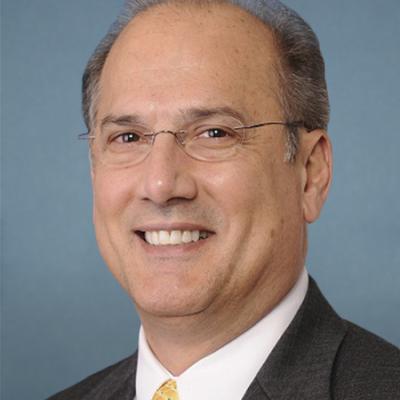

Rep. Tom Marino | 12 |  Republican

Republican

|

Yes | |

|

Sen. Roger Marshall |  Republican

Republican

|

Yes | ||

|

Rep. Thomas Massie | 4 |  Republican

Republican

|

Yes | |

|

Rep. Brian Mast | 21 |  Republican

Republican

|

Yes | |

|

Rep. Doris Matsui | 7 |  Democrat

Democrat

|

No | |

|

Rep. Kevin McCarthy | 20 |  Republican

Republican

|

Yes |

Pagination

2018 House Key Votes

- Tribal Labor Sovereignty Act

- Financial Stability Oversight Council Improvement Act

- Stress Test Improvement Act

- Proposing a Balanced Budget Amendment to the U.S. Constitution

- Volcker Rule Regulatory Harmonization Act

- Amendment to the FAA Reauthorization Act of 2018 Striking Prevailing Wage Requirements

- FAA Reauthorization Act of 2018

- Water Resources Development Act of 2018

- Securing America's Future Act of 2018

- Agriculture and Nutrition Act of 2018

- Financial Services and General Government Appropriations, 2019

- Increasing Access to Lower Premium Plans and Expanding Health Savings Accounts Act of 2018

- Restoring Access to Medication and Modernizing Health Savings Accounts Act of 2018

- Protecting Family and Small Business Tax Cuts Act of 2018

- Motion to Concur on a Bill That Gives More Tax Cuts for the Wealthy and Corporations