Protecting Family and Small Business Tax Cuts Act of 2018

Sep. 28, 2018 | H.R. 6760

To justify a second round of tax cuts, this misnamed bill is doubling down on the discredited economic theory that another $657 billion in tax breaks for the wealthy and corporations will strengthen our economy and provide “trickle-down” benefits to working families. This $2 trillion tax giveaway has done little to strengthen the economy and, more importantly, working families have not come close to getting the $4,000 salary raise promised by the bill’s proponents. Instead, we have seen worsening economic inequality and some $710 billion in corporate stock buybacks–a phenomenon of little, if any benefit, to middle class Americans. There is no justification whatsoever for this tax cut, yet it passed the House on Sept. 28, 2018.

This is Bad for working people.

Vote result: Passed

YEAs: 220

NAYs: 191

| Legislator | State | District | Party Sort descending | Vote | |

|---|---|---|---|---|---|

|

Rep. Susan A. Davis | 53 |  Democrat

Democrat

|

No | |

|

Rep. Michelle Lujan Grisham | 1 |  Democrat

Democrat

|

Not Voting | |

|

Rep. Judy Chu | 28 |  Democrat

Democrat

|

No | |

|

Rep. Mike Quigley | 5 |  Democrat

Democrat

|

No | |

|

Rep. Steny H. Hoyer | 5 |  Democrat

Democrat

|

No | |

|

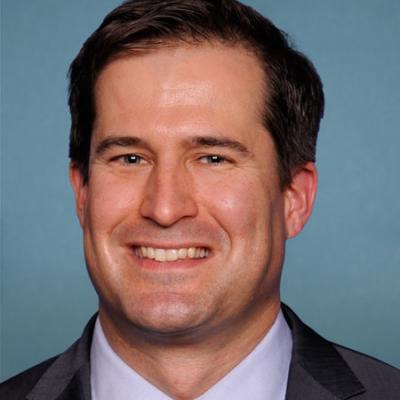

Rep. Seth Moulton | 6 |  Democrat

Democrat

|

Not Voting | |

|

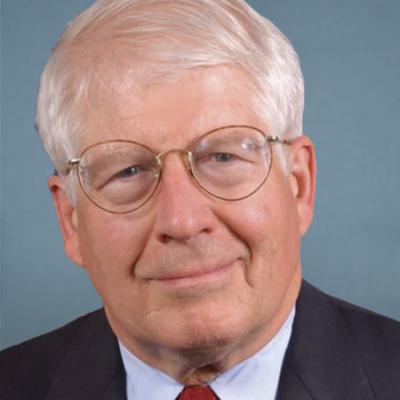

Rep. Earl Blumenauer | 3 |  Democrat

Democrat

|

No | |

|

Rep. Vicente Gonzalez | 34 |  Democrat

Democrat

|

No | |

|

Rep. Linda T. Sánchez | 38 |  Democrat

Democrat

|

No | |

|

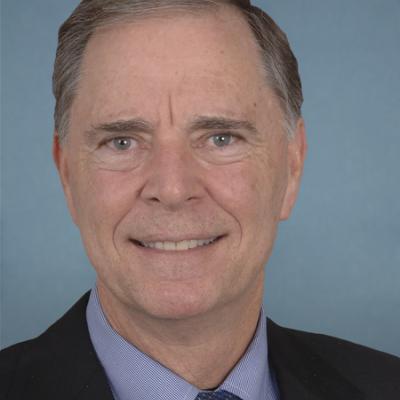

Rep. David E. Price | 4 |  Democrat

Democrat

|

No | |

|

Rep. Gwen Moore | 4 |  Democrat

Democrat

|

No | |

|

Rep. Jimmy Gomez | 34 |  Democrat

Democrat

|

No | |

|

Rep. Justin Amash | 3 | Independent Independent | Yes | |

|

Sen. Kyrsten Sinema | ID ID | Yes | ||

|

Rep. Steven J. Chabot | 1 |  Republican

Republican

|

Yes | |

|

Rep. Peter T. King | 2 |  Republican

Republican

|

No | |

|

Rep. Bill Posey | 8 |  Republican

Republican

|

Yes | |

|

Rep. George Holding | 2 |  Republican

Republican

|

Yes | |

|

Rep. Alex Mooney | 2 |  Republican

Republican

|

Yes | |

|

Sen. Marsha Blackburn |  Republican

Republican

|

Not Voting |

Pagination

- Tribal Labor Sovereignty Act

- Financial Stability Oversight Council Improvement Act

- Stress Test Improvement Act

- Proposing a Balanced Budget Amendment to the U.S. Constitution

- Volcker Rule Regulatory Harmonization Act

- Amendment to the FAA Reauthorization Act of 2018 Striking Prevailing Wage Requirements

- FAA Reauthorization Act of 2018

- Water Resources Development Act of 2018

- Securing America's Future Act of 2018

- Agriculture and Nutrition Act of 2018

- Financial Services and General Government Appropriations, 2019

- Increasing Access to Lower Premium Plans and Expanding Health Savings Accounts Act of 2018

- Restoring Access to Medication and Modernizing Health Savings Accounts Act of 2018

- Protecting Family and Small Business Tax Cuts Act of 2018

- Motion to Concur on a Bill That Gives More Tax Cuts for the Wealthy and Corporations