Economic Growth, Regulatory Relief and Consumer Protection Act

Mar. 14, 2018 | S. 2155

This misnamed bill puts consumers and our economy at greater risk by weakening important financial regulations put in place after the 2008 crisis to protect Americans from predatory lending and promote financial stability. It undermine the current safety and soundness requirements that apply to mid-size banks and gives even the largest Wall Street megabanks new statutory tools for pressuring the Federal Reserve to weaken regulations designed to make banks more accountable. It weakens protections against predatory, unaffordable mortgage lending practices and broadens exemptions from the mortgage affordability requirements created by Dodd-Frank. The bill passed the Senate on March 14, 2018, and became law on May 24, 2018.

Legislative Alert

This is Bad for working people.

Vote result: Passed

YEAs: 67

NAYs: 31

| Legislator Sort descending | State | Party | Vote | |

|---|---|---|---|---|

|

Sen. Claire McCaskill |  Democrat

Democrat

|

Yes | |

|

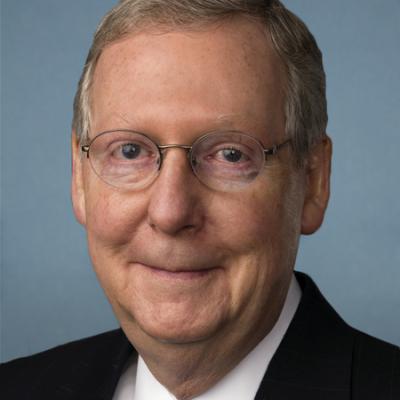

Sen. Mitch McConnell |  Republican

Republican

|

Yes | |

|

Sen. Robert Menendez |  Democrat

Democrat

|

No | |

|

Sen. Jeff Merkley |  Democrat

Democrat

|

No | |

|

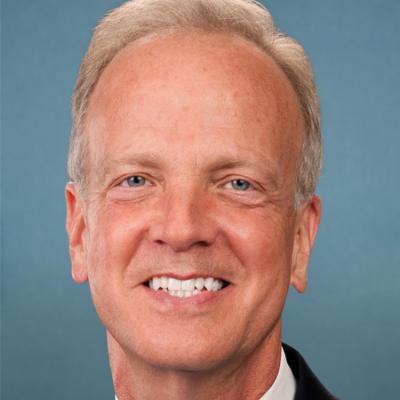

Sen. Jerry Moran |  Republican

Republican

|

Yes | |

|

Sen. Lisa Murkowski |  Republican

Republican

|

Yes | |

|

Sen. Christopher S. Murphy |  Democrat

Democrat

|

No | |

|

Sen. Patty Murray |  Democrat

Democrat

|

No | |

|

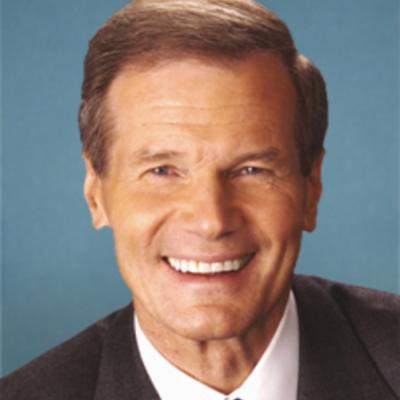

Sen. Bill Nelson |  Democrat

Democrat

|

Yes | |

|

Sen. Rand Paul |  Republican

Republican

|

Yes | |

|

Sen. David Perdue |  Republican

Republican

|

Yes | |

|

Sen. Gary Peters |  Democrat

Democrat

|

Yes | |

|

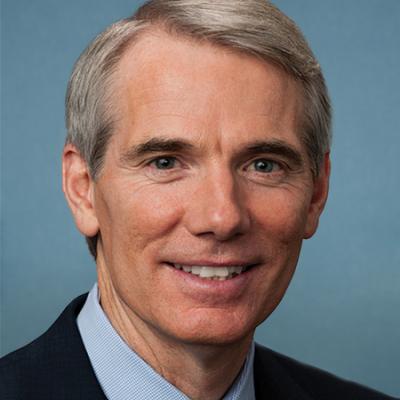

Sen. Rob Portman |  Republican

Republican

|

Yes | |

|

Sen. Jack Reed |  Democrat

Democrat

|

No | |

|

Sen. Jim Risch |  Republican

Republican

|

Yes | |

|

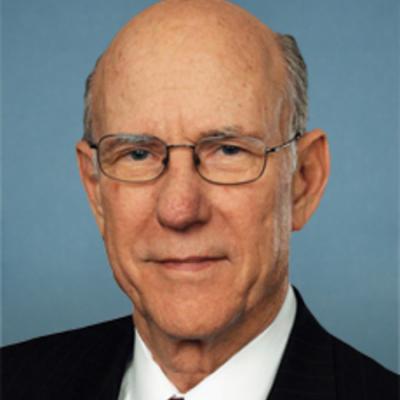

Sen. Pat Roberts |  Republican

Republican

|

Yes | |

|

Sen. Mike Rounds |  Republican

Republican

|

Yes | |

|

Sen. Marco Rubio |  Republican

Republican

|

Yes | |

|

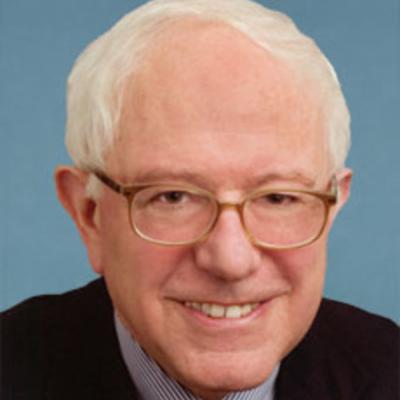

Sen. Bernard Sanders | ID ID | No | |

|

Sen. Ben Sasse |  Republican

Republican

|

Yes |

Pagination

- Cloture Vote: Amendment to the Broader Options for Americans Act

- Economic Growth, Regulatory Relief and Consumer Protection Act

- Confirmation of John F. Ring to the National Labor Relations Board

- Cloture Vote: Amendment to the Tribal Labor Sovereignty Act

- Confirmation of Brett M. Kavanaugh to the United States Supreme Court