Middle Class Tax Cuts Act

Jul. 25, 2012 | S. 3412

This Democratic legislation would extend tax cuts on income under $250,000 for joint filers ($200,000 for individuals) or about 98% of taxpayers as well as 97% of small business owners. It would end the Bush tax breaks for the richest 2 percent and save the federal government nearly $1 trillion over the next 10 years; revenue that could be invested in jobs, infrastructure improvements, education, and protecting programs like Medicare and Medicaid, as well as reducing the deficit. The middle class tax cut was passed.

This is Good for working people.

Vote result: Passed

YEAs: 51

NAYs: 48

| Legislator Sort descending | State | Party | Vote | |

|---|---|---|---|---|

|

Sen. Dean Heller |  Republican

Republican

|

No | |

|

Sen. John Hoeven |  Republican

Republican

|

No | |

|

Sen. Kay Bailey Hutchison |  Republican

Republican

|

No | |

|

Sen. James M. Inhofe |  Republican

Republican

|

No | |

|

Sen. Daniel K. Inouye |  Democrat

Democrat

|

Yes | |

|

Sen. Johnny Isakson |  Republican

Republican

|

No | |

|

Sen. Mike Johanns |  Republican

Republican

|

No | |

|

Sen. Ron Johnson |  Republican

Republican

|

No | |

|

Sen. Tim Johnson |  Democrat

Democrat

|

Yes | |

|

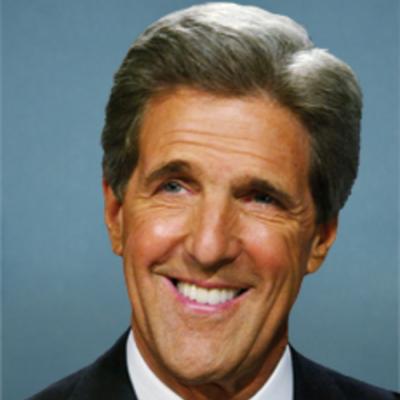

Sen. John Kerry |  Democrat

Democrat

|

Yes | |

|

Sen. Mark Steven Kirk |  Republican

Republican

|

Not Voting | |

|

Sen. Amy Klobuchar |  Democrat

Democrat

|

Yes | |

|

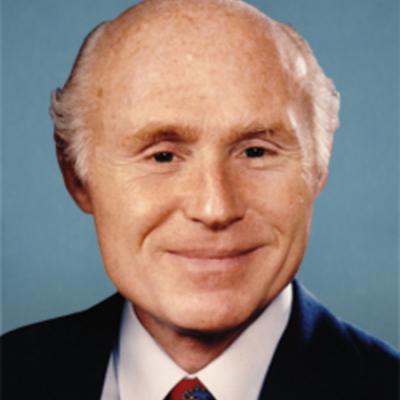

Sen. Herb Kohl |  Democrat

Democrat

|

Yes | |

|

Sen. Jon Kyl |  Republican

Republican

|

No | |

|

Sen. Mary L. Landrieu |  Democrat

Democrat

|

Yes | |

|

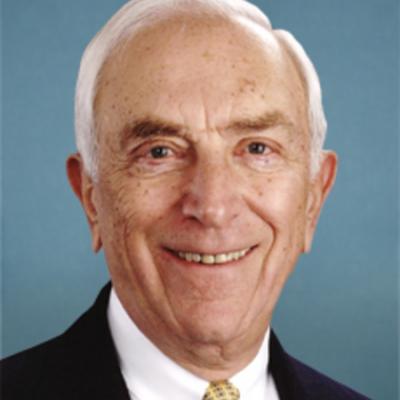

Sen. Frank R. Lautenberg |  Democrat

Democrat

|

Yes | |

|

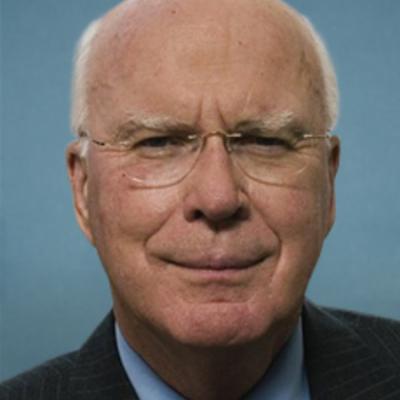

Sen. Patrick J. Leahy |  Democrat

Democrat

|

Yes | |

|

Sen. Mike Lee |  Republican

Republican

|

No | |

|

Sen. Carl Levin |  Democrat

Democrat

|

Yes | |

|

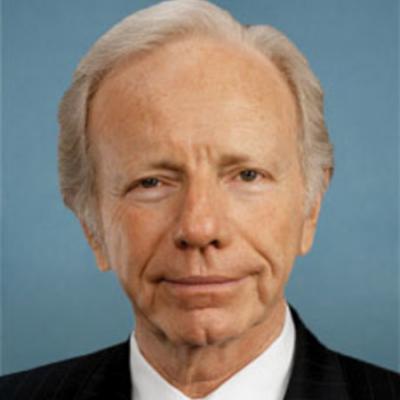

Sen. Joseph I. Lieberman | Independent Independent | No |

Pagination

2012 Senate Key Votes

- Moving Ahead for Progress in the 21st Century Act

- Jumpstart Our Business Startups

- Paying a Fair Share Act of 2012

- Repeal of NLRB's Fair Election Rules

- Amendment to Limit Union Representation Rights in the Workplace

- Amendment to Circumvent Collective Bargaining Agreements

- Bring Jobs Home Act

- Amendment to Extend the Bush Tax Cuts for the Wealthy

- Middle Class Tax Cuts Act

- Amendment to Repeal Prevailing Wage Laws

- Disaster Relief Appropriations Act, 2013