Protecting Family and Small Business Tax Cuts Act of 2018

Sep. 28, 2018 | H.R. 6760

To justify a second round of tax cuts, this misnamed bill is doubling down on the discredited economic theory that another $657 billion in tax breaks for the wealthy and corporations will strengthen our economy and provide “trickle-down” benefits to working families. This $2 trillion tax giveaway has done little to strengthen the economy and, more importantly, working families have not come close to getting the $4,000 salary raise promised by the bill’s proponents. Instead, we have seen worsening economic inequality and some $710 billion in corporate stock buybacks–a phenomenon of little, if any benefit, to middle class Americans. There is no justification whatsoever for this tax cut, yet it passed the House on Sept. 28, 2018.

This is Bad for working people.

Vote result: Passed

YEAs: 220

NAYs: 191

| Legislator | State | District Sort descending | Party | Vote | |

|---|---|---|---|---|---|

|

Rep. Richard Hudson | 9 |  Republican

Republican

|

Yes | |

|

Rep. Michael McCaul | 10 |  Republican

Republican

|

Yes | |

|

Rep. Patrick T. McHenry | 10 |  Republican

Republican

|

Yes | |

|

Rep. Paul Mitchell | 10 |  Republican

Republican

|

Yes | |

|

Rep. Donald M. Payne Jr. | 10 |  Democrat

Democrat

|

No | |

|

Rep. Scott Perry | 10 |  Republican

Republican

|

Yes | |

|

Rep. Barbara Comstock | 10 |  Republican

Republican

|

Yes | |

|

Rep. Brad Schneider | 10 |  Democrat

Democrat

|

No | |

|

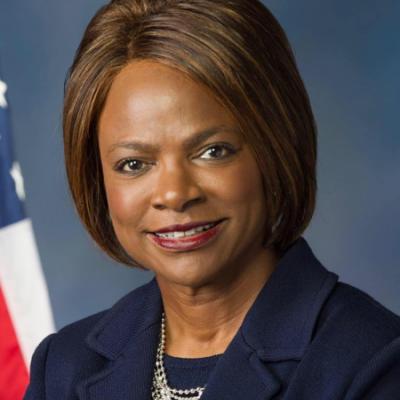

Rep. Val Demings | 10 |  Democrat

Democrat

|

No | |

|

Rep. Jeffrey Denham | 10 |  Republican

Republican

|

Yes | |

|

Rep. Mark DeSaulnier | 10 |  Democrat

Democrat

|

No | |

|

Rep. Michael R. Turner | 10 |  Republican

Republican

|

Yes | |

|

Rep. Denny Heck | 10 |  Democrat

Democrat

|

No | |

|

Rep. Jody Hice | 10 |  Republican

Republican

|

Yes | |

|

Rep. Barry Loudermilk | 11 |  Republican

Republican

|

Yes | |

|

Rep. Lou Barletta | 11 |  Republican

Republican

|

Yes | |

|

Rep. Mark Meadows | 11 |  Republican

Republican

|

Yes | |

|

Rep. Nancy Pelosi | 11 |  Democrat

Democrat

|

No | |

|

Rep. K. Michael Conaway | 11 |  Republican

Republican

|

Yes | |

|

Rep. Gerald E. Connolly | 11 |  Democrat

Democrat

|

No |

Pagination

- Tribal Labor Sovereignty Act

- Financial Stability Oversight Council Improvement Act

- Stress Test Improvement Act

- Proposing a Balanced Budget Amendment to the U.S. Constitution

- Volcker Rule Regulatory Harmonization Act

- Amendment to the FAA Reauthorization Act of 2018 Striking Prevailing Wage Requirements

- FAA Reauthorization Act of 2018

- Water Resources Development Act of 2018

- Securing America's Future Act of 2018

- Agriculture and Nutrition Act of 2018

- Financial Services and General Government Appropriations, 2019

- Increasing Access to Lower Premium Plans and Expanding Health Savings Accounts Act of 2018

- Restoring Access to Medication and Modernizing Health Savings Accounts Act of 2018

- Protecting Family and Small Business Tax Cuts Act of 2018

- Motion to Concur on a Bill That Gives More Tax Cuts for the Wealthy and Corporations