Volcker Rule Regulatory Harmonization Act

Apr. 13, 2018 | H.R. 4790

This bill would undermine the implementation of the Volcker Rule by giving sole rulemaking authority to the Federal Reserve and allowing banks with less than $10 billion in assets to engage in proprietary trading with publicly insured deposits. A core component of the Volcker Rule is to prevent banks from using deposited money to finance speculative trading. Yet, the bill would cut the Federal Deposit Insurance Corporation (FDIC), the custodian and institutional protector of the deposit insurance fund, entirely out of the implementation of the Volcker Rule. H.R. 4790 would eliminate the FDIC’s role in writing and interpreting the rule and weaken the interpretation of the rule and its enforcement. If enacted this bill has the potential to unravel the regulatory system aimed at preventing the need for future bailouts of “too-big-to-fail” financial institutions. The bill passed the House on April 11, 2018, and referred to the Senate Banking Committee.

This is Bad for working people.

Vote result: Passed

YEAs: 300

NAYs: 104

| Legislator Sort descending | State | District | Party | Vote | |

|---|---|---|---|---|---|

|

Rep. Pete Sessions | 17 |  Republican

Republican

|

Yes | |

|

Rep. Terri Sewell | 7 |  Democrat

Democrat

|

Not Voting | |

|

Rep. Carol Shea-Porter | 1 |  Democrat

Democrat

|

Not Voting | |

|

Rep. Brad Sherman | 32 |  Democrat

Democrat

|

Yes | |

|

Rep. John Shimkus | 15 |  Republican

Republican

|

Yes | |

|

Rep. Bill Shuster | 9 |  Republican

Republican

|

Yes | |

|

Rep. Mike Simpson | 2 |  Republican

Republican

|

Not Voting | |

|

Sen. Kyrsten Sinema | ID ID | Yes | ||

|

Rep. Albio Sires | 8 |  Democrat

Democrat

|

No | |

|

Rep. Lamar Smith | 21 |  Republican

Republican

|

Not Voting | |

|

Rep. Christopher H. Smith | 4 |  Republican

Republican

|

Yes | |

|

Rep. Adrian Smith | 3 |  Republican

Republican

|

Yes | |

|

Rep. Jason Smith | 8 |  Republican

Republican

|

Yes | |

|

Rep. Adam Smith | 9 |  Democrat

Democrat

|

No | |

|

Rep. Lloyd Smucker | 11 |  Republican

Republican

|

Yes | |

|

Rep. Darren Soto | 9 |  Democrat

Democrat

|

No | |

|

Rep. Jackie Speier | 14 |  Democrat

Democrat

|

No | |

|

Rep. Elise Stefanik | 21 |  Republican

Republican

|

Yes | |

|

Rep. Chris Stewart | 2 |  Republican

Republican

|

Yes | |

|

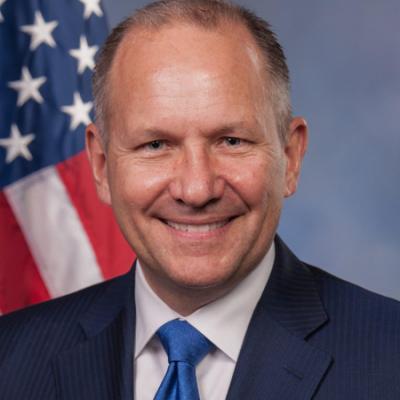

Rep. Steve Stivers | 15 |  Republican

Republican

|

Yes |

Pagination

- Tribal Labor Sovereignty Act

- Financial Stability Oversight Council Improvement Act

- Stress Test Improvement Act

- Proposing a Balanced Budget Amendment to the U.S. Constitution

- Volcker Rule Regulatory Harmonization Act

- Amendment to the FAA Reauthorization Act of 2018 Striking Prevailing Wage Requirements

- FAA Reauthorization Act of 2018

- Water Resources Development Act of 2018

- Securing America's Future Act of 2018

- Agriculture and Nutrition Act of 2018

- Financial Services and General Government Appropriations, 2019

- Increasing Access to Lower Premium Plans and Expanding Health Savings Accounts Act of 2018

- Restoring Access to Medication and Modernizing Health Savings Accounts Act of 2018

- Protecting Family and Small Business Tax Cuts Act of 2018

- Motion to Concur on a Bill That Gives More Tax Cuts for the Wealthy and Corporations